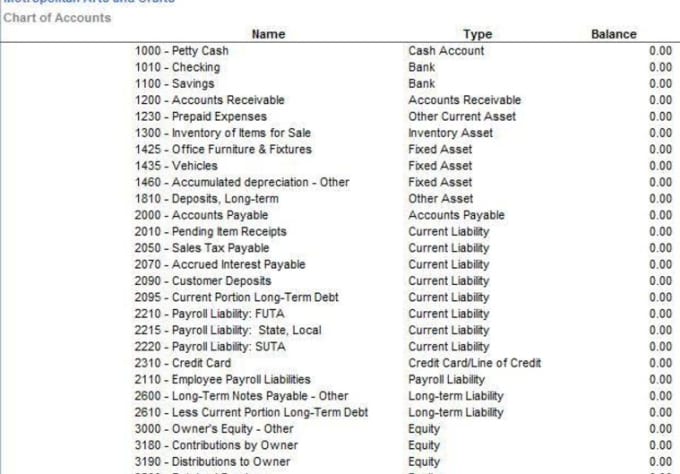

Chart Of Accounts For Small Business

Chart Of Accounts For Small Business. Think about the chart of accounts as the foundation of a building, in the chart of accounts you decide how your transactions are categorized and reported in your financial statements. The first digit of the number signifies if it is an asset, liability, etc.

This another different format that has been crafted for making it unique from the old-school patterns.

The following list of accounts should be adequate for compiling an income statement and balance sheet under a double entry bookkeeping system.

These accounts are grouped according to five main account types: asset accounts, liability accounts, expense accounts, equity accounts, and revenue accounts. Your chart of accounts needs to be designed intentionally. The chart of accounts for small business template will help you to produce your own chart of accounts, and is available for download in Excel format by following the link below.

Rating: 100% based on 788 ratings. 5 user reviews.

Duane Montoya

Thank you for reading this blog. If you have any query or suggestion please free leave a comment below.

0 Response to "Chart Of Accounts For Small Business"

Post a Comment