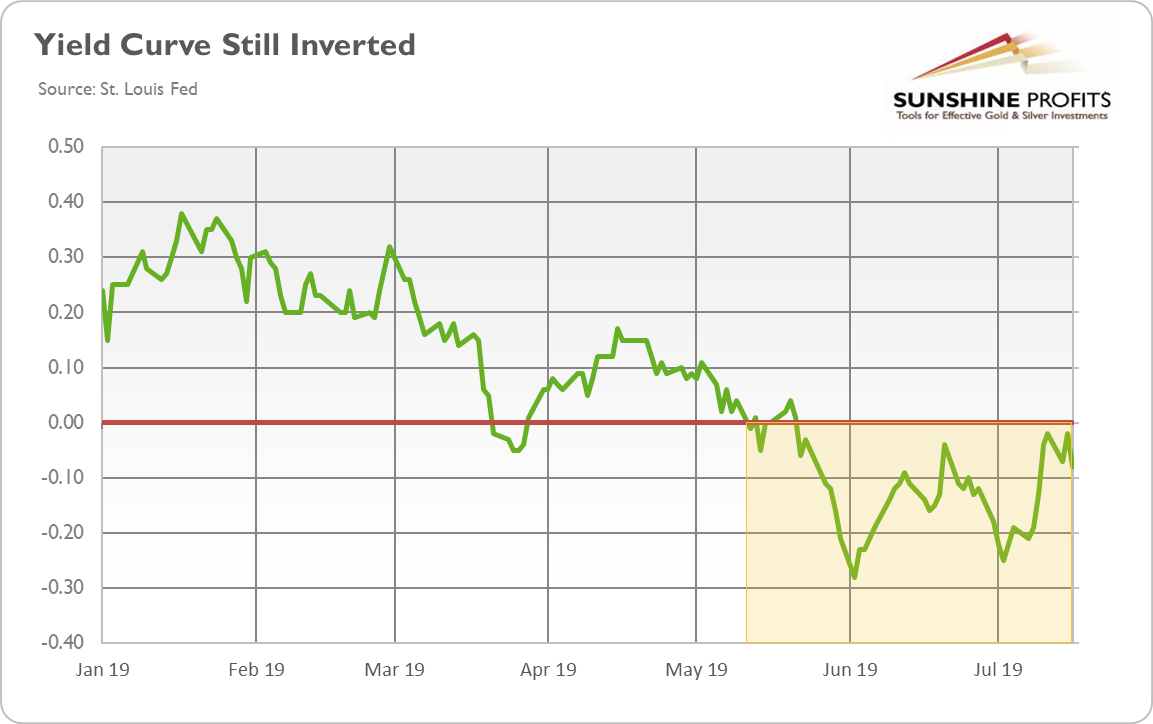

Current Yield Curve Chart

Current Yield Curve Chart. These market yields are calculated from composites of indicative, bid-side market quotations (not actual transactions) obtained by the Federal Reserve Bank of. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market.

This curve, which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the over-the-counter market.

These are instruments that settle on overnight unsecured interest rates (the SONIA rate in the UK).

Yield Curve is inverted in Long-Term vs Short-Term Maturities. The red line is the Yield Curve. The slope of the Treasury yield curve is a popular recession predictor with an excellent track record.

Rating: 100% based on 788 ratings. 5 user reviews.

Duane Montoya

Thank you for reading this blog. If you have any query or suggestion please free leave a comment below.

0 Response to "Current Yield Curve Chart"

Post a Comment